NC State MBA Startup Tethis Receives Wolfpack Investor Network’s Largest Capital Raise to Date

“No matter what the entrepreneur is telling you at the front of the room, it probably won’t be the same going forward,” says Joe Sinsheimer, managing director of the Wolfpack Investor Network (WIN), with offices in the James B. Hunt Library on Centennial Campus.

His statement comes from experience. In his role with WIN and prior roles in investment organizations, Sinsheimer has seen many startups pivot from their initial plan. “There are always variables; the world changes,” he said. That requires the entrepreneur to be flexible and open to taking a venture in a new direction. It also requires a supportive network that provides not only funding but also mentorship and coaching.

Sinsheimer cites Tethis as a prime example of a startup making that pivot well. The company was co-founded by Scott Bolin (MBA ’12) based on work he and fellow students did in their technology, entrepreneurship and commercialization (TEC) concentration team project while in the NC State Jenkins MBA program. Bolin now is Tethis’ chief executive officer.

Making the Pivot

The Tethis team initially developed a business concept based on using a corn-based fiber – developed by professors Joel Pawlak and Richard Venditti in NC State’s College of Natural Resources – to filter pollutants out of water used in the fracking process.

As Sinsheimer said, in the startup world, things change, and Tethis responded. It now is using the technology to produce a biodegradable absorbent material for diapers and is exploring potential uses in other fluid absorption products.

Tethis made its pivot about three and a half years ago, Bolin said. ”We were fortunate to be able to meet with a few diaper companies back then who were able to help us map out the features they really liked about our technology, which let us hone in very quickly as we pivoted.

That was about the time that Tethis began working with WIN, and the pivot made it more attractive to members of the WIN network, which recently participated in a $17.6 million capital raise for the company – WIN’s largest investment in a single venture.

Early on, Tethis had benefited from mentorship provided by NC State alumnus Chris Evans, an experienced entrepreneur in the area who served as Bolin’s mentor through the Triangle-based Blackstone Entrepreneurs Network and now serves as executive chairman at Tethis.

Alumni Engagement Opportunities

“There’s a significant group of alumni wanting to invest in ventures being launched by their fellow NC State alums,” Sinsheimer said. The majority of WIN’s investors are in North Carolina, but it also has members in Atlanta, Indianapolis, Los Angeles, Minneapolis and Philadelphia. WIN members – whether as investors or startups – must have an NC State connection, such as being alumnus, faculty member, employee, retiree, board member or other affiliation.

For investors, WIN provides its members “unique deal flow,” he said, meaning proprietary access to strong investment opportunities that have been prescreened, “bringing only the most credible deals to WIN members.”

WIN also enables its members to bring their expertise into the university’s ecosystem as mentors and coaches, he said.

“Successful alumni are trying to create a virtuous circle,” Sinsheimer said, one that is “spinning out companies, sharing proceeds with the alumni base and investing in future entrepreneurs.” The university also benefits because in many cases – like Tethis – the University Endowment is co-investing with the WIN membership.

Alumni engagement is a big plus for Thetis, Bolin said. Beyond WIN’s financial investment, “I’m most excited about having a broader network of supporters. We’ve already reached out to a few about connections and insights.”

This kind of engagement reflects the evolving role of the university as an engine that drives economic, societal and intellectual prosperity through innovation, Sinsheiner said. “We don’t want technology to stay on campus. We need to get it off campus, to create jobs. That’s a challenge because commercial and research worlds are different places. WIN is trying to break that down in terms of capital resources, and we have a lot of alumni and retirees that think investing through WIN is a way to give back.”

Diligence and ROI

WIN’s diligence process provides investors with an analysis of each investment opportunity, including its risks and rewards. A key part of the diligence is completed by WIN’s Associate Team: graduate-level students, faculty and staff from the NC State Poole College of Management, the College of Engineering, College of Agriculture and Life Sciences, and others.

Lisa Chang, director of Technology, Entrepreneurship and Commercialization (TEC) in Poole College, leads the WIN diligence program. A licensed pharmacist and program director with more than 20 years of management experience, she coordinates with department heads across campus to identify top STEM and MBA students to work on WIN’s Associate Team and supervises their work in the diligence process. She also recruits faculty to assist with WIN’s initial processes for screening applicant companies.

”The opportunity for interdisciplinary teams of NC State graduate students to work with an angel network has been incredible,” Chang said. “ Many of them have entrepreneurial aspirations themselves, and the unique inside view of how growing companies operate that they get through WIN is both a great reality check and inspiration.

“WIN members really appreciate the detailed reports that the students produce, and use them to guide their investing decisions. Universally, our MBA and STEM students have told us the due diligence process is one of the most rewarding experiences they’ve had at NC State, a true reflection of Think and Do that they can apply to their future careers,” she said.

As of mid-February 2017, WIN, which launched in December of 2016, had 118 investor members and had invested in 11 deals with 10 portfolio companies representing a wide range of sectors. It also is working collaboratively with the Duke Angel Network (DAN) and the Carolina Angel Network (CAN) to establish the new Triangle Venture Alliance (TVA). Through this alliance, all three networks will share best practices, resources and ultimately investment opportunities.

Also on the WIN leadership team are: Abby Phillips, program coordinator; steering committee members Raj Narayan, associate director of the Kenan Institute for Engineering, Technology and Science; Lewis Sheats, Poole College associate professor of entrepreneurship, executive director of the NC State Entrepreneurship Clinic and assistant vice provost for entrepreneurship; Tom Miller, senior vice provost for academic outreach and entrepreneurship, and Wade Fulghum, director of the Office of Technology Commercialization and New Ventures.

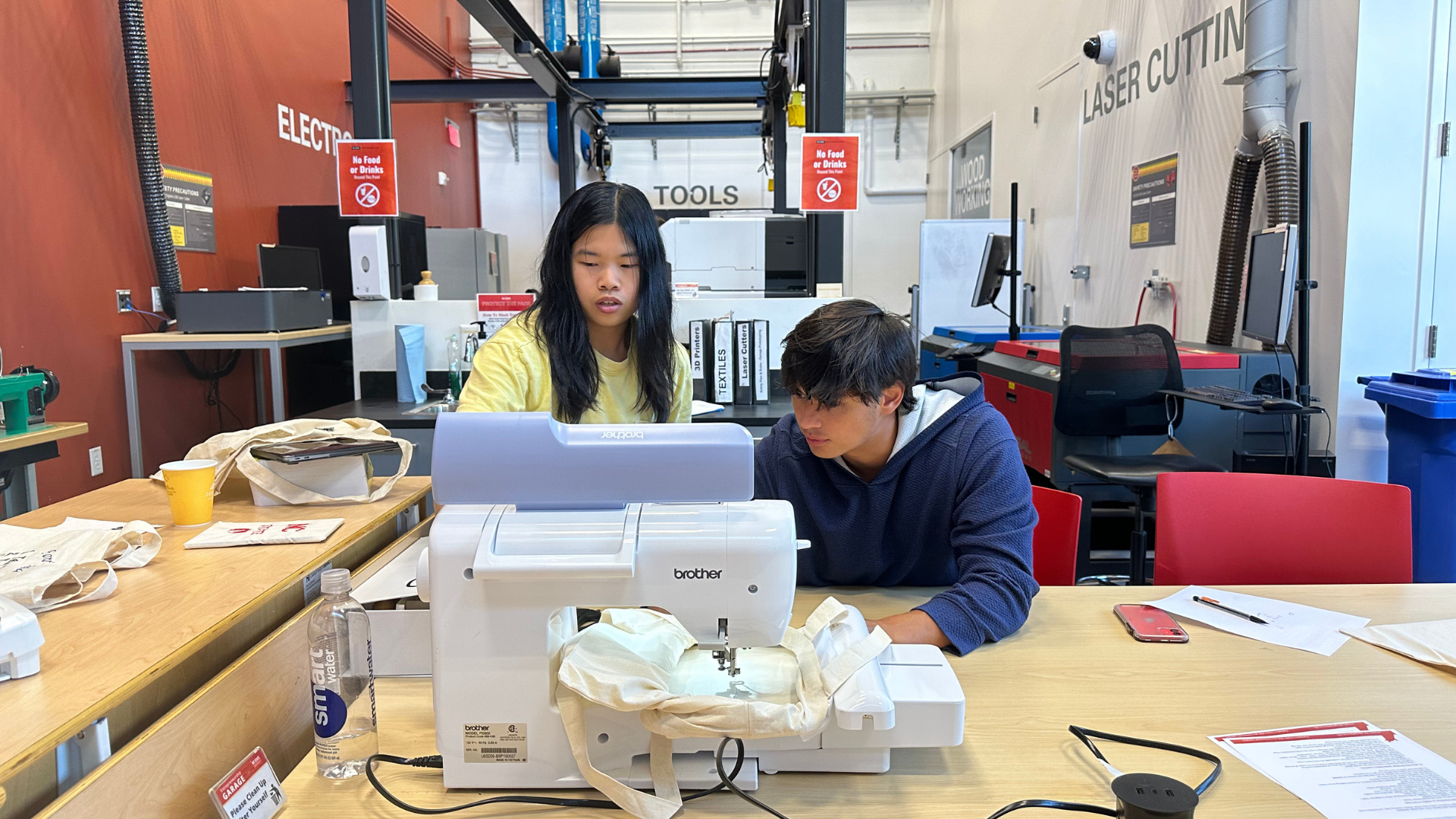

In the Photo: Diligence Team Members, left to right: London White, HiTEC Scholar and Diligence Team Leader; Mackenzie Urquhart, NC State Poole College junior majoring in finance and intern; and WIN Diligence Team members Joshua Lissauer, Jenkins MBA; Rob Ascenzi; Gary Sanguinetti and Andrew Bowker, Jenkins MBA program; and John Bowen, graduate student, chemical and biomolecular engineering, College of Engineering.

- For more information about the Wolfpack Investor Network, click here.

- For more information about the due diligence process, contact Lisa Chang.

- Read more about Tethis.

This post was originally published in Poole College of Management News.