Wolfpack Investor Network Surpasses $15 Million in Capital Deployed

Demonstrating its crucial role as an economic engine in North Carolina, the Wolfpack Investor Network (WIN) announced that it has reached $15 million in investments since its inception in December of 2016.

About WIN

WIN is an organization housed within NC State University to connect NC State-tied early stage, high growth companies to a group of individual angel investors, most of whom have ties to the university. By actively engaging and matching NC State alumni network expertise with portfolio companies, WIN empowers the businesses that drive our future and economic development forward.

WIN is part of the Triangle Venture Alliance, a partnership between NC State, Carolina Angel Network (UNC-Chapel Hill) and the Duke Angel Network (Duke University) to co-invest in opportunities where there is a connection to more than one university represented on the management team or in the IP portfolio. As of February 2021, the Triangle Venture Alliance has invested over $53 million dollars into 73 portfolio companies – since their inception within the past 5 years.

“WIN provides its portfolio companies with the leveraged power and support of NC State’s entrepreneurial ecosystem and alumni network and its member-investors with a private, collaborative network with curated opportunities from startup companies with strong NC State connections,” said Abby Phillips, Assistant Director for Member Services at WIN.

“During 2020 our investor members continued to support their existing investments and funded a number of new opportunities. Global events have a way of creating new markets, changing perspectives and driving innovation and it has been exciting to watch these companies innovate while navigating a dynamic year. Similarly, we are looking forward to in person WIN member meetings but will also offer these meetings virtually for our members that live outside the Triangle or prefer to engage online,” shared Brett Danforth, Managing Director at WIN.

About WIN Ventures

To date, WIN’s member-investors and sidecar investors – including Venture Capital Multiplier Fund, Triangle University Fund and NC State University’s Seed Capital Endowment Fund – have invested over $15 million into 25 leading-edge startups who are disrupting their respective markets.

Examples include:

–Diveplane, Raleigh, NC (Artificial Intelligence): Groundbreaking technology start-up dedicated to keeping the best of humanity in artificial intelligence. CEO, Mike Capps.

–Reveal Mobile, Raleigh, NC: (Ad Tech): Creates accurate and precise mobile audience segments to help companies advertise effectively by using patented beacon detection and latitude/longitude data. CEO, Brian Handly.

–Spiffy, Raleigh, NC (Consumer Services) Provides full-service mobile car washes and detailing as well as on-board diagnostics. CEO, Scot Wingo,

–Advanced Animal Diagnostics, Morrisville, NC (Animal Health): provides livestock producers with on-site diagnostics that improve profitability and empower more precise care of animals so they live healthier, more productive lives. CEO, Joy Parr Drach.

–Reborn Clothing Co., Raleigh, NC (Consumer Product): Reduces and reuses textile waste to give unused or outdated items new life by partnering with brands to identify surplus and deadstock textiles and upcycling them into new products. CEO, Emily Neville.

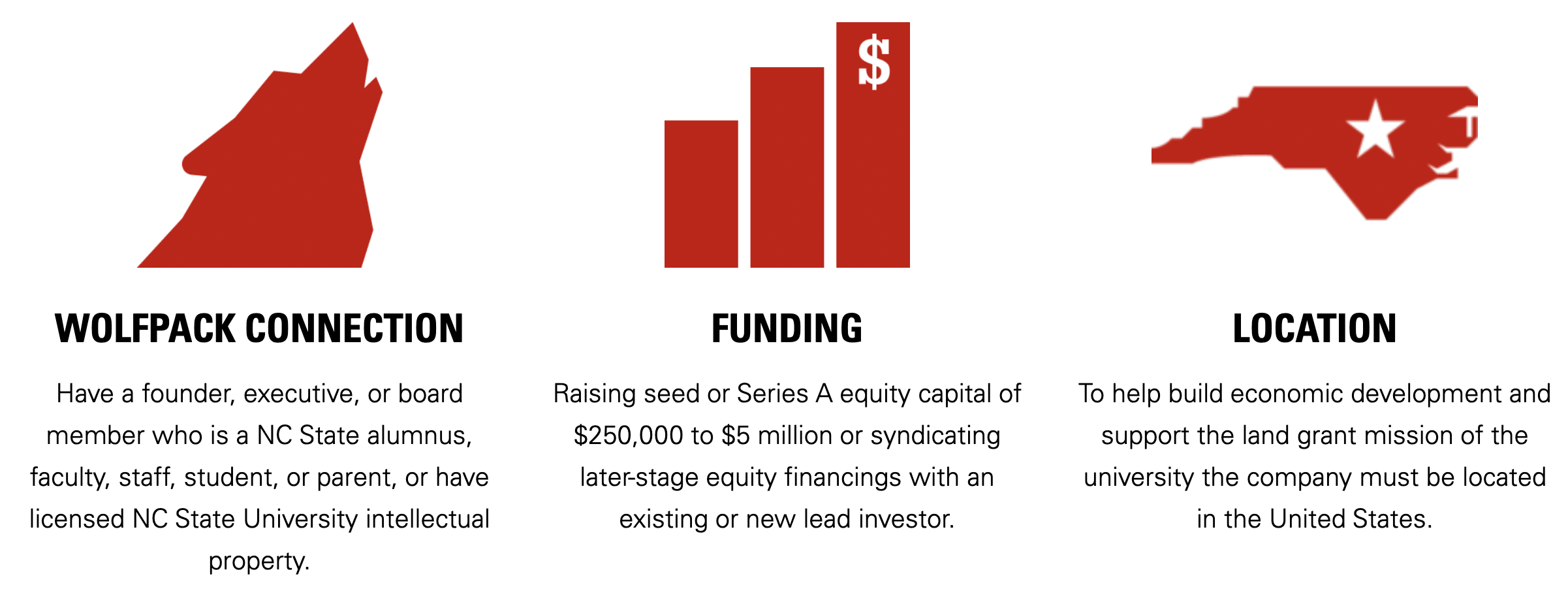

Portfolio companies must meet the following criteria:

Most of the companies WIN has invested in are headquartered in the Triangle area and 23 of 25 are headquartered in NC. “These companies drive innovation, job creation, and positive environmental impact in North Carolina and beyond, all while strengthening the reputation of NC State University as an institution that is investing in innovation,” Phillips stated.

Creating an Educational Impact

The portfolio companies are not the only ones that reap the benefit of mentorship and learning. Each company selected to present to WIN is interviewed by a due diligence team made up of current NC State MBA and STEM graduate students. These teams of 3-5 students then prepare due diligence reports for WIN members to review before making investment decisions. “Working with WIN provides a holistic view of all lessons and courses from the Jenkins MBA. This hands-on-experience, which can incorporate everything from viewing financial reports, researching technical features, and interviewing executives, has proven invaluable in my graduate studies and career as a whole,” shared due diligence analyst and MBA candidate, John Swann.

“This educational process has proven to be a valuable experience for graduate students to communicate with company management teams, review and organize complex information, and network with successful alumni members,” Phillips stated. “WIN member-investors are enthusiastic that the network provides hands-on educational opportunities for students and future alumni,” Phillips added.

Reflecting back on the experience gained as part of the due diligence team, Swann added “The exposure to WIN has challenged how I think, improved my writing and communication skills, and provided the opportunity to meet new and interesting people. WIN has been the perfect complement to the entrepreneurial focus I have chosen for the Jenkins MBA.”

Companies interested in securing funding or investors interested in becoming WIN members can learn more via the website.

This story was originally published May 11, 2021.

- Categories: